Alexa is part of the family now

- Sep 23, 2021

- 5 min read

With over a quarter of UK households owning a smart-speaker, Alexa is becoming a member of the family.

From roughly 2018 to 2021 Voxly Digital focused on building Voice Apps for Amazon Alexa and Google Assistant, and we became one of the Top 3 UK based agencies doing this work.

This blog post highlights work from that time and showcases how we approach strategy and execution around cutting edge tech like Amazon Alexa

Voice-assistants are part of our lives and here to stay. With over a third of UK households owning a smart-speaker (2022), and Google reporting half a billion monthly users (2020), adoption of voice technology will likely to soar in the years to come.

Growth is coming from its intuitive nature and the rapid adoption of the technology amongst younger audiences; many of whom are growing up using Alexa or Google Assistant multiple times a day around the house.

With most smart-speakers in kitchens and living rooms, we were interested in measuring voice use in households over multiple generations. For example, we looked at questions like:

Are children more confident than their parents with voice tech?

How do families use voice collectively?

What do families use Voice Assistants for? Is it different from individual use?

We at Voxly Digital wanted to find out.

In this report, we share the results of our first Voxly Voice Insights survey (March 2020) and discover that Alexa and Google Assistant play a much more pivotal role in family life than just setting timers for boiled eggs. In fact, the results reveal that UK families with smart-speakers are highly engaged, frequent, sociable and varied voice-users. They are a fertile focus area for the right brands looking to develop voice-apps. Read on for the results.

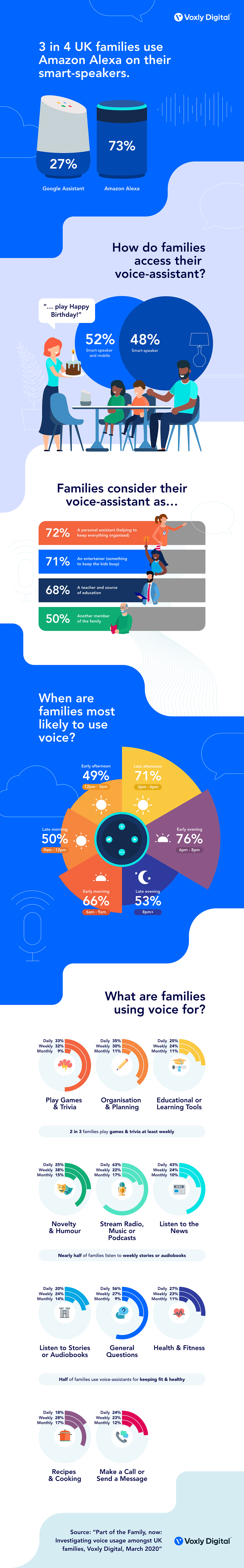

Alexa is the family favourite

Alexa is the overwhelmingly preferred voice-assistant for families, with 73% of families using Amazon Alexa on their smart-speakers. Given that 90% of respondents felt that as a family, they were “on their phones too much”, the humble smart-speaker solves a key issue for families.

However, smart-speakers are not the only channel for families interacting with voice - with 52% reported using voice-assistants on both their mobiles and with smart-speakers; reinforcing the importance of designing family-focussed experiences which can work beyond Echo devices.

More than just the family calendar

The role of the voice-assistant in family households emerged as broader than you might think. In fact, whilst 74% of people agreed that they see Alexa and Google Assistant as ‘personal assistants', almost the same number (72%), saw their voice-assistants as ‘entertainers’. With 1 in 3 families reporting that they play games on their voice-assistants daily, this is encouraging for brands who are considering engaging their audiences through gamification with voice.

Unsurprisingly given their search capabilities, voice-assistants are seen as a source of information and education for most families. In fact, with 55% of adults agreeing that their ‘kids find it hard to have the motivation to learn something new outside of school’, it makes sense for so many of them to be turning to Alexa and Google Assistant to help deliver information in an engaging, user-led way for their children.

However, given information is a key function of their assistants, it’s significant to see that this figure (69%) is not hugely higher than the number who consider their voice-assistant to be ‘another family member’. For brands, the intimate and trusted role that voice-assistants are playing in homes should not be overlooked as an opportunity.

One more before bed, Dad?

Families reported using voice most often between the end of school and bedtime, with 75% of families being most likely to voice-assistants between 6 - 8pm. Developing voice-experiences which piggyback the family rituals and needs in these key times will stand brands looking to establish their voice amongst families in good stead.

So long Monopoly, voice-apps are here...

The most popular use of the family smart-speaker is for streaming traditional audio content, such as the news, music, radio and podcasts, which families reported to do mostly daily.

With 75% of families feeling that their ‘lives are getting busier and more stressful’, it’s not surprising that that same proportion are turning to their voice-assistants at least weekly for family organisation and planning.

However, games and humour emerged as a very significant reason for families to use their smart-speakers, with 1 in 3 reporting that they play games & trivia apps via voice daily. 65% of families play at least weekly with a similar figure (63%) emerging for weekly use of novelty & humour apps also.

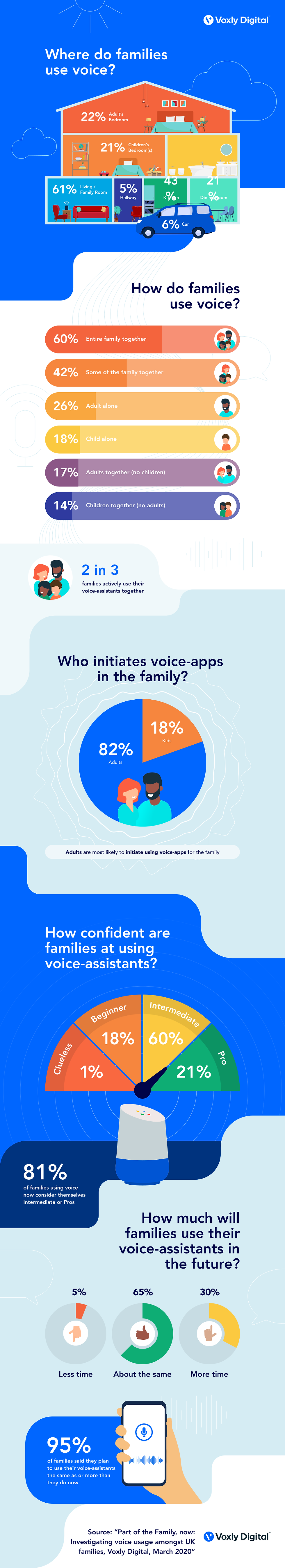

Families stick together

Using voice-assistants in the household is a more sociable and collaborative process for most families than you might think.

61% of families use their voice-assistants in the Living/Family Room whilst 43% of them use them in the kitchen. Whilst common rooms don't necessarily equate group usage, further insights revealed that 2 in 3 families actively use their voice-assistants together.

Using voice-apps such as games and workout routines can be not just group but sociable activities in themselves. Considering this context whilst design experiences is vital.

Understanding who will be listening, how this might impact usage and how they might be better engaged themselves, can help brands develop more memorable experiences.

“I never know how to work these things...”

78% of household adults reported that their kids have more confidence & knowledge using new tech than them. However, it’s the adults who are most likely to initiate using voice-apps for the family. Only 18% of the time, respondents report, it is the children who initiate voice-experiences. This may suggest a confidence gap amongst children knowing what to ask their voice-assistants.

But confidence is growing across the board. In our surveyed families, 81% who use voice consider themselves Intermediate or Pros with the tech, with only 19% classing themselves as Beginners or Clueless. As daily usage of voice-assistants continues over time, we predict family familiarity with voice tech will also go up.

Voice is here to stay in family life

95% of families said they plan to use their voice-assistants the same as or more than they do now. 30% said they plan to use it more, reinforcing the importance of voice as a channel for brands looking to engage families.

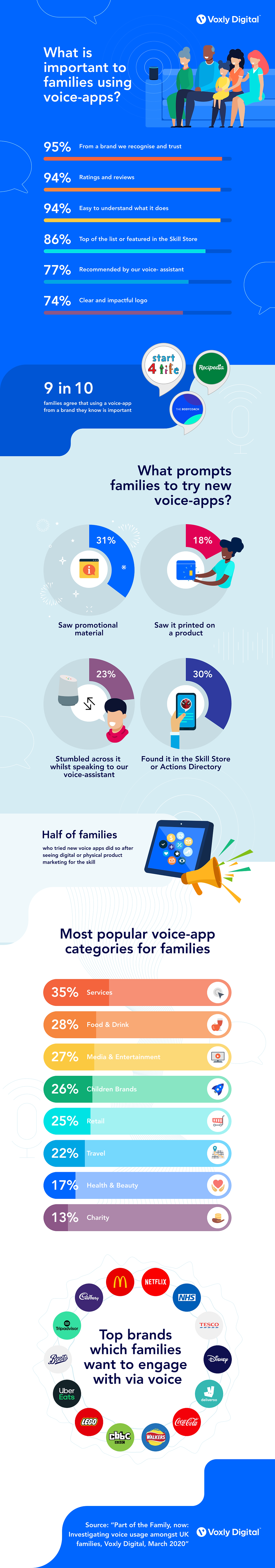

There’s appetite for family favourites on voice platforms

When asked about their motivations for using voice-apps, 9 in 10 families claimed that using a service from a brand they know is important. In fact, the strength of the brand was considered just as important as ratings & reviews and the ease of comprehension, showing the scale of opportunity which exists for brands looking to develop family voice-experiences.

Families also reported they were willing to engage with brands across a range of sectors via voice, including service brands such as the NHS and entertainment brands like Netflix; once again revealing the range of roles which Alexa & Google Assistant play for UK families.

Drive acquisition through word of mouth, promotion, and the Alexa Skill Store

To prompt families to try new skills, the most effective tactics appear to be word of mouth, promotional marketing and visibility on voice-app directories such as the Amazon Skill Store. 49% of families who tried new voice apps did so after seeing digital or physical product marketing for the skill.

Organic discovery also remains a significant channel; with 30% of families actively browsing the Skill Store looking for new apps to try and 23% of families trying a new app after their voice-assistant recommended it to them.

Methodology:

The survey was conducted online during the March 2020 and was completed by 400 UK adults aged 18 or older that were demographically representative of the UK population as a whole. Respondents were screen based on their responses to ‘Do you use a voice-assistant (e.g. Amazon Alexa, Google Assistant)?’. Figures have not been adjusted and are shown directly as from findings.

Breakdown of respondents:

Number of children: 1 child (39%), 2 children (34%), 3 children (16%), 4 children (10%), 5+ children (1%) . Ages of children: 0 - 3 years (26%), 4 - 6 years (33%), 7 - 9 years (34%), 10 - 12 years (28%), 13 - 15 (24%) and 16 - 18 years (16%).

Comments